Four years ago, on January 13, 2018, the Payments Services Directive 2 (PSD2) came into force. Under this directive, open banking became a regulatory requirement in the UK. Open banking has truly revolutionized the way in which consumers and businesses manage their financial data, asserting the UK’s status as a global leader in innovative financial services.

The UK Open banking met its fourth anniversary with a whopping 4.5 million active users, 60 per cent rise in new clients (as compared with December 2020), and around 27 million open banking payments processed in 2021.

In this article, we’ll explore the concept of open banking, provide the answer to the question “Why the UK?”, take a closer look at the leading Open Banking providers, and finally, focus on the major benefits of this cutting-edge tech. Let’s get down to business.

What is Open Banking?

Open Banking is a practice of enabling third-party financial service vendors to access consumers’ personal financial data, such as banking and transactions, through the use of APIs (application programming interfaces). It connects banks, third parties, and technical providers – enabling them to simply and securely exchange data to their customers’ benefit and allowing them to initiate transactions from a customer’s account, such as sending payments or withdrawing money.

One of the primary goals of Open Banking is to promote competition and drive innovation across the financial services industry by allowing fintech companies to create brand-new banking services.

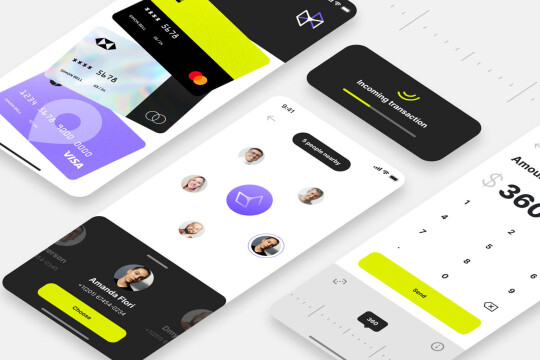

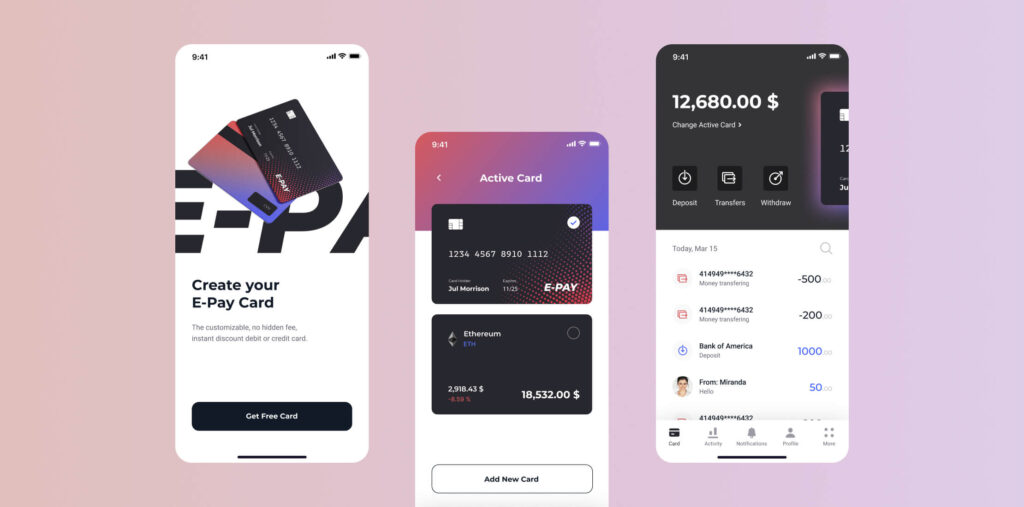

As a result, this is the ultimate consumer who reaps the benefits of Open Banking by getting direct access to innovative financial services. Imagine that all your data about accounts, operations, transactions, bills, and expenses are securely stored in one place — a mobile app, and you can manage your finances in a convenient way. Having access to this data, financial institutions can carefully analyze it and offer you a more customized product.

PSD2: how it all started

How did it all start? What events have triggered the emergence of open banking? If you dig a little deeper in history, you’ll find out that the first attempts to digitalize banking took place back in 1983, when a restricted number of consumers were allowed to make online transfers by dialling *300#. At that time, it was an outstanding opportunity.

With technological advancement, fintech made a giant leap. Over thirty years later, in 2015, PSD2 (Second Payment Services Directive, or Revised Payment Services Directive) was issued to regulate payment services and their providers across the European Union and European Economic Area. The document was adopted to respond to the blistering pace of digitalization in the banking sector and the need to provide consumers with improved, innovative services. The Directive focuses on stimulating pan-European competition and involvement of non-banks in the payments industry. In addition, it aims at harmonizing consumer protection practices throughout the EU.

In Europe, PSD2 came into force in January 2018, but the practical implementation began on September 14, 2019, when the technical standards in user protection were enforced.

These standards introduced rules for enhanced customer authentication and requirements for platforms for open access to banking information.

Why is the UK so good at open banking?

The UK has been an undisputed world leader in open banking. It is estimated that half the UK’s small businesses and over four million consumers have chosen services powered by open banking technology.

So what lies behind the UK’s success story? The United Kingdom made its first steps in establishing a solid open banking infrastructure before PSD2 came into effect. Following the introduction of PSD2, in 2016, the Competition and Market Authority (CMA) required nine of the largest financial institutions to open access to their APIs. The direction came into force on January 13, 2018, resulting in banks’ transformation into service providers. Banks perform client onboarding and open accounts, while fintech companies develop interfaces and new products as well as provide a variety of services. This greatly facilitates market development since not all banks are FinTech, and not all fintech projects are exclusively banking institutions.

To efficiently deliver Open Banking and in order to create software standards and industry guidelines, the UK’s Competition and Markets Authority set up the Open Banking Implementation Entity, also known as Open Banking Limited. The company is governed by the CMA and funded by the United Kingdom’s nine major banks and building societies: Nationwide, Barclays, Allied Irish Bank, Lloyds Banking Group, Bank of Ireland, RBS Group, Santander, Danske, and HSBC.

Open Banking in the UK surpassed PSD2, and there are some valid reasons for that. First, by establishing a single API standard and making it compulsory for the nine largest banks, Open Banking in the UK considerably streamlined getting into the market. Next, clear regulations helped to build up trust between consumers and fintech vendors. In the United Kingdom, the open banking evolution has been more focused on consumers rather than being controlled by the banks.

Leading open banking providers in the UK

As of the third quarter of 2021, 327 FCA-regulated financial providers (third parties) are enrolled in open banking in the United Kingdom. This number is constantly growing; however, some financial service providers remain a hard act to follow. Let’s take a closer look at them.

Tink

With revolutionizing traditional financial services in mind, Daniel Kjellén and Fredrik Hedberg started Tink in Stockholm, Sweden, in 2012. Today, Tink is operating in eighteen markets in Europe and Latin America and cooperates with around 3.5 thousand banks and financial institutions. Tink boasts fruitful partnerships with banking giants such as Dutch ABN AMRO, Portuguese CGD, British NatWest, and many others.

Truelayer

TrueLayer was set up in 2016 by Francesco Simoneschi and Luca Martinetti. They aimed at providing smart open banking services that could make fintech available to everyone and enable businesses to create first-rate financial experiences. TrueLayer is trusted by most of Europe’s major banks and a number of clients across the globe, such as AI assistant Plum, peer-to-peer lender Zopa, renting fintech Canopy, and digital bank Monzo. What is more, TrueLayer has recently won a contract with the UK government to help launch its Payment Initiation Service across the Crown Commercial Service.

Plaid

Plaid was founded in 2012 by Zach Perret and William Hockey in San Francisco. At present, it connects to more than 15 thousand financial institutions in North America and Europe, and 5,000 fintech companies are built on Plaid. Apart from securely connecting bank accounts to fintech services, Plaid promises its customers aesthetically pleasing user experiences. Some of Plaid’s customers include Varo, Brigit, Wave, Solo, Prosper, and Astra.

Yapily

Yapily was established in 2017 by Stefano Vaccino, who was inspired by the social impact of open banking and the immense potential it offers. Yapily’s primary goal is to help businesses spruce up their offerings by embedding open banking into their products and services. By successfully combining technology and expertise, Yapily attracted big clients, such as GoCardless and IBM. Today, this fintech boasts 80 per cent account coverage throughout Europe and 99 per cent coverage in the United Kingdom and is expected to expand further.

Benefits of Open Banking

Without a doubt, open banking is the future of the financial industry. To remain competitive, banking industry players shouldn’t ignore the growing popularity of open banking. A number of institutions are already working towards adopting the practice, so understanding the potential advantages of using open banking APIs is essential.

Enhanced service offerings

By adopting and deploying APIs, a financial institution can significantly improve its native services and offerings by enabling third-party financial service providers to develop innovative solutions. With effective cooperation between banks and technical service providers, the possibilities are limited only by the existing technology.

Centralization of services

Switching to the bank-as-a-platform model allows for efficient centralization of services. Banks maintain complete control over financial advice, savings account, loans, transfers, and money management. Consequently, all the processes are run with enhanced transparency and under a single administration.

Seamless business processes

Open banking can considerably improve the way small to medium-sized businesses operate. By entrusting accounting, payroll management, and auditing to third parties, business owners can focus on their marketing efforts and enhance their service offerings.

Financial operations are becoming conveniently accessible

With open banking, access to technology is the single requirement to carry out financial operations. Online banking allows customers living in remote areas or unable to access brick-and-mortar branches to fully use tailored banking services.

Greater customer satisfaction

Open banking services enable financial institutions to motivate consumers to interact with their financial data in innovative ways and help them get valuable insights to improve their financial behaviours and decisions. In addition, by providing fintech companies with secure access to bank account information, banks receive a unique opportunity to personalize customer experiences with analytical precision, for instance, to offer tailored recommendations based on the consumer’s financial behaviour.

Room for innovation

Consumer data at hand allows third-party providers to deliver solutions that can bring financial services to a brand-new level. The open banking model will enable institutions to understand data privacy mandates and changes to introduce, facilitating more informed and innovative decision-making.

Increased digital revenue

Enhancing the quality of financial services, which leads to increased customer engagement, also means growing digital revenue.

Challenges facing open banking

Open banking is truly revolutionizing financial services and empowering consumers like never before. However, like many other innovative initiatives, it has some challenges to take on.

Fragmentation

Open banking creates excellent opportunities for banks across Europe, enabling them to strengthen their service portfolios and bring their interaction with customers to a brand new level. However, these opportunities are seriously hampered by the lack of a single established API standard.

The absence of a single API standard interferes with the key objective of Open Banking to develop a consolidated, innovative, Europe-wide digital environment for financial products.

Although the standards for PSD2 are established in the Regulatory Technical Standards (RTS), they stop short of defining a communal API. This resulted in creation of the national versions of the API standard, such as UK’s OBWG and Berlin Group’s “NextGenPSD2”. What is more, major banks are considering the option of developing their own sets of APIs.

‘90-day’ rule

The ’90-day’ rule – the requirement for clients to re-authenticate with each bank every 90-days when accessing account information via a third-party provider (TPP) – significantly hurts open banking adoption.

If a customer is multi-banked and uses a service to view all bank accounts in one place, 90-day re-authentication creates considerable inconvenience and almost negates all the benefits. Drop-off rates were above 50 per cent.

Good news:

In December 2021, the Financial Conduct Authority (FCA) has announced that customers would no longer need to re-authenticate with their account servicing payment service providers (ASPSPs) every three months as part of Strong Customer Authentication (SCA) rules.

Under the new regulation, TPPs will instead need to reconfirm consent with the customer every 90 days. For security purposes, authentication with the bank will be still required when customers connect their account to a third-party service for the first time.

Security concerns

One of the significant challenges facing open banking is security. Although digital technologies have proved to be more secure than traditional banking services, there still exists a stigma attached to possible cybersecurity threats.

However, open banking requires the maximum security levels, and getting services provided by third parties creates the need for multi-factor authentication, for example, entering a password and a code sent via a text message. Plus, customer data is fully protected by the security services encrypted in the financial institution’s infrastructure. With fintech evolving at a blistering pace, security will only increase.

Lack of education

Also, the lack of knowledge among customers is likely to slow down the seamless adoption of cutting-edge technologies. Many people still prefer conventional branch-based banking as they have reservations about sharing their data. To prevent innovations from being limited by customers’ scepticism, banks and fintech companies need to educate consumers on how open banking can improve their financial management.

The bottom line

All in all, open banking has considerably facilitated a digital transformation in the financial sector. Without any doubt, breaking the barriers created around customer data, open banking is becoming a significant source of innovation that reshapes the banking industry.

The UK has reached spectacular success in open banking innovations and implementations. What were the keys to this success? It’s not a secret – regulation, simplicity, and partnership, sticking to which can drive even more impressive results.

* * *

DeepInspire is a boutique software development company with deep fintech expertise and 20+ years of experience.

We provide outstanding software solutions by addressing both technology and business challenges. Whether you are a large enterprise, a midsize business, or a young startup, we are happy to help you dominate the turbulent and competitive market.

Feel free to check out our case studies or drop us a line at [email protected] to discuss your next project.