Personal Finance Software Development

- "All-in-one-place" experienceSeamlessly integrate with core banking systems and payment service providers to deliver the perfect "all-in-one-place" experience

- Data visualisationMake the information understandable and manageable with user-friendly and concise data visualisation

- GamificationKeep users engaged and encourage them to achieve their goals with gamification

- AI-powered financial assistanceDeliver customised insights and personalised recommendations with AI-powered financial assistance

- We can help you build a comprehensive financial wellbeing platform designed to enhance individuals' overall financial health by offering tools, resources, and personalised guidance to manage money, reduce financial stress, and achieve long-term financial wellbeing.

Let’s chat through your needs.

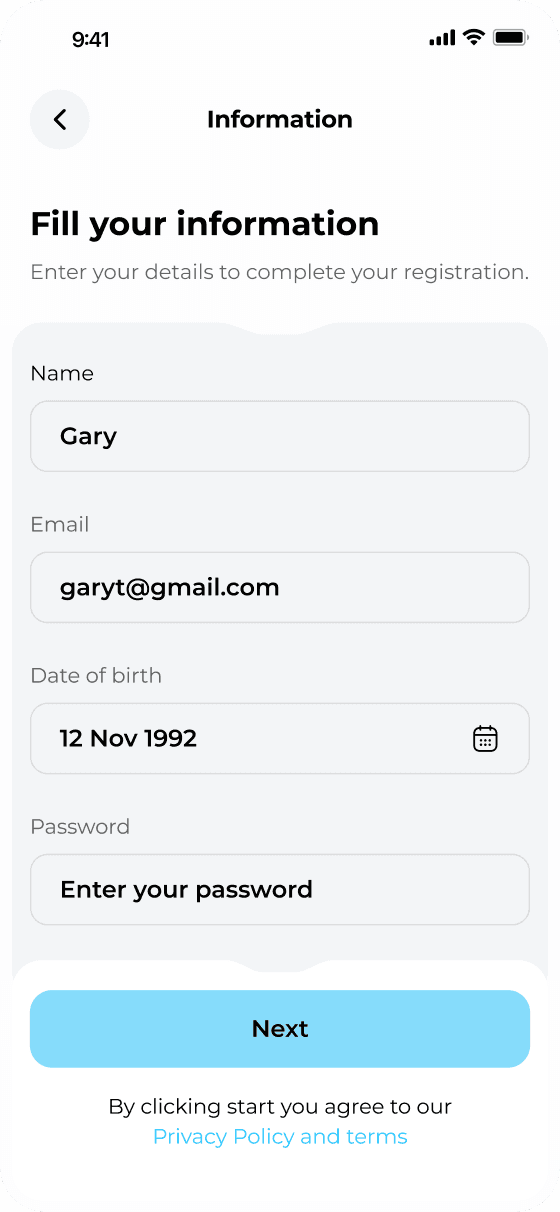

Ensure the ultimate security and trust with our robust identity verification feature. Our apps offer a seamless authentication process, providing your users with peace of mind and reliable protection against potential threats.

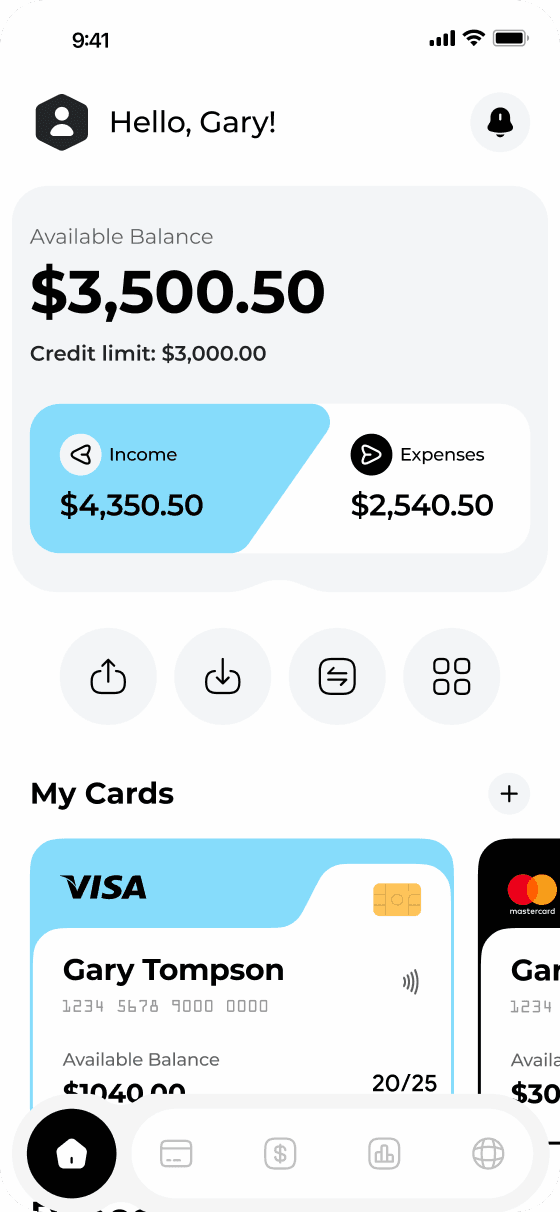

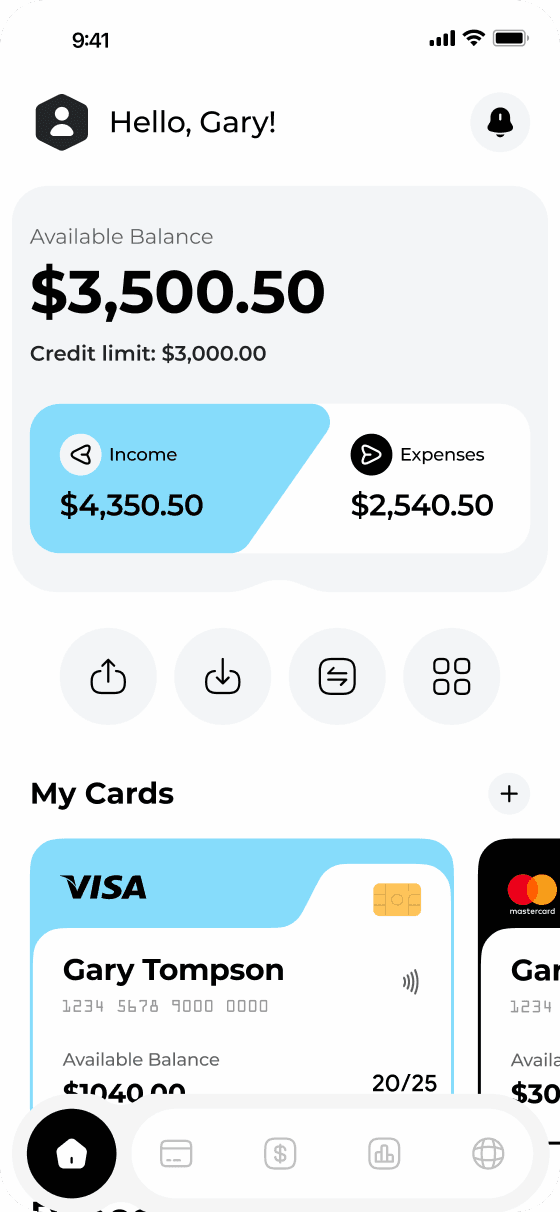

Our financial apps help streamline financial management by linking and managing multiple bank accounts within a single platform.

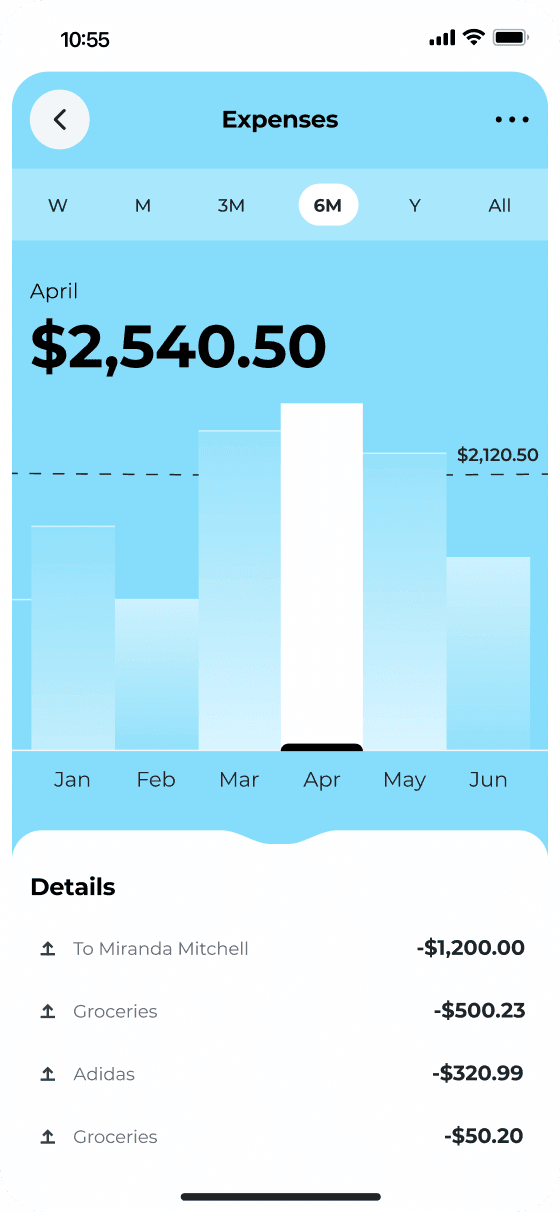

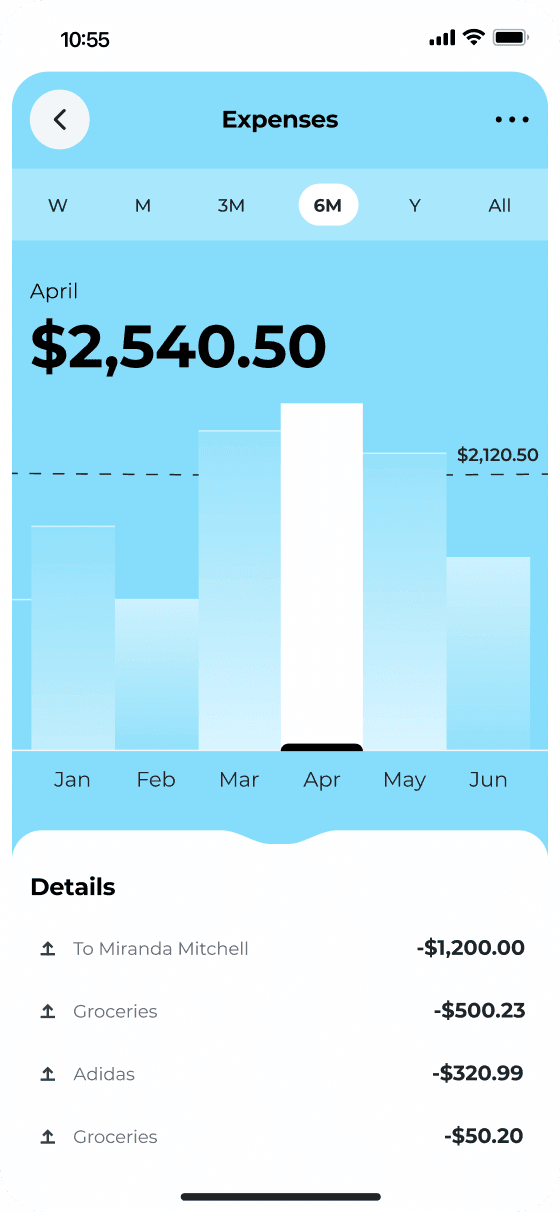

This feature allows app users to analyse and optimise expenses to help them save money and eliminate unnecessary costs, maximising the potential of their income.

With this feature, your users will never miss a bill payment. It allows for setting up customised payment schedules and provides timely reminders.

Let your consumers confidently plan for their financial future by implementing our intuitive budget estimation feature. This robust budgeting tool enables users to anticipate potential challenges and capitalise on opportunities for long-term success.

The automatic investment and savings functionality we offer enables users to navigate their investments from the comfort of their mobile devices and watch as their savings grow over time.

Our personal finance management apps provide users with complete clarity into financial patterns thanks to the income and spending categorisation feature. It lets users easily track and understand their financial flows, facilitating better financial decisions.

Empower your users to take charge of their debts by offering an effective refinancing and optimisation tool. It enables individuals to seamlessly reorganise debts and optimise repayment plans, ensuring greater financial stability.

Keep your users informed at all times with detailed analytical reports. This feature gives access to comprehensive financial summaries and performance metrics, allowing users to strategically approach their personal finance management.

We offer a comprehensive retirement planning feature to let your personal finance application users effortlessly plan, track, and adjust retirement savings to ensure a comfortable and prosperous future.

Let your users compete, collaborate, and celebrate achievements with friends and family, turning financial management into an enjoyable experience, ensuring active user engagement, and increasing customer satisfaction.

This advanced feature leverages cutting-edge technology to provide consumers with tailored recommendations and expert guidance for optimal financial planning.

- Back-end Development

- Front-end Web and Mobile Development

- Solution Architecture

- Cloud & DevOps

- Business Analysis

- Product Management

- UI/UX Design

- Quality Assurance

- Client Support

DeepInspire is the best development team I’ve ever worked with and I’ve been in development for 30 years now.

I was struck by their immediate understanding of our challenges and issues before they even dived into the code. They made a huge effort to understand exactly how the code worked and what our customers were looking for.

Because of this, I’ve engaged with DeepInspire on different projects at a different company since then. They continue to impress me even more.

I have had the good fortune to work with the leadership team of DeepInspire for several years.

I trust them absolutely. They care deeply about their clients, their people and their company. They hire the most talented individuals and deliver great ideas together with exceptional service.

Everyone from our team has been highly impressed by what DeepInspire has brought to the table.

Everyone from our team has been highly impressed by what DeepInspire has brought to the table regarding their work focus, their attention to detail, and the way that they address problems and solutions.

They constantly do small things that we don’t necessarily ask for and without needing to be asked.

The prototype has generated over 10 business client opportunities that we are pursuing.

DeepInspire team managed to deliver a high-fidelity prototype in less than 4 weeks, on time to present in front of our 350 strategic clients, at our annual flagship customer conference. The feedback that we have received has been phenomenal and we were able to validate product/market fit instantly using design thinking methodology.

The prototype has generated over 10 business client opportunities that we are pursuing. We are already working with the team to flash out several other innovative concepts that will help us drive business revenue from brand-new product ideas.

Our level of trust in them allows us to step back and let them run the project and even deal with our clients.

DeepInspire is a well-managed team with a vested interest in the client's success. They are far more interested in making my business a success than billing hours and winning more work.

The team members were highly intelligent and provided valuable advice and suggestions rather than just blindly following instructions. When a service provider genuinely has your company's best interest at heart, then anything is possible. DeepInspire lives that.

We are very grateful to Deepinspire for their professionalism, creativity, and commitment to our cause.

The Justice Beyond Borders project simply would not have been possible without this talented team.

They managed, on a very tight schedule, to find a beautiful, logical, and functional solution to a complex task we put in front on them. The result speaks for itself, and we are being repeatedly complemented by users not only for the substance, but equally for the simplicity of the user experience and beautiful design.

The most impressive thing is that they listen to the client and adapt their abilities with a passion and a desire to over-deliver.

Pavlo and the entire team at Deepinspire provide an environment that promotes an agile approach to development. An open forum where creative solutions are formed and quickly made real.

From my experience, perhaps the most impressive thing is that they listen to the client and adapt their abilities with a passion and a desire to over-deliver.

It is like being part of a team rather than a client-agency relationship.

There is no doubt in my mind that without DeepInspire, my idea would still be little more than a PowerPoint presentation. I approached them with the bare bones of the life story app with no real expertise in technology or, in fact, running a startup tech business. They have been there every step of the way.

Never feeling out of my depth and being fully involved with every part of the development has given me the confidence I need as a CEO of LifeLibrary to deliver a best-in-sector care home platform.

- A personal finance app is a software application designed to assist individuals in managing their financial activities and improving their overall financial well-being. These apps offer tools and features such as budgeting, expense tracking, investment monitoring, bill reminders, financial goal setting, and sometimes educational resources to help users make informed decisions about their money. They are typically accessible on mobile devices and provide a convenient way for users to gain insights into their financial habits, plan for the future, and optimise their financial health.