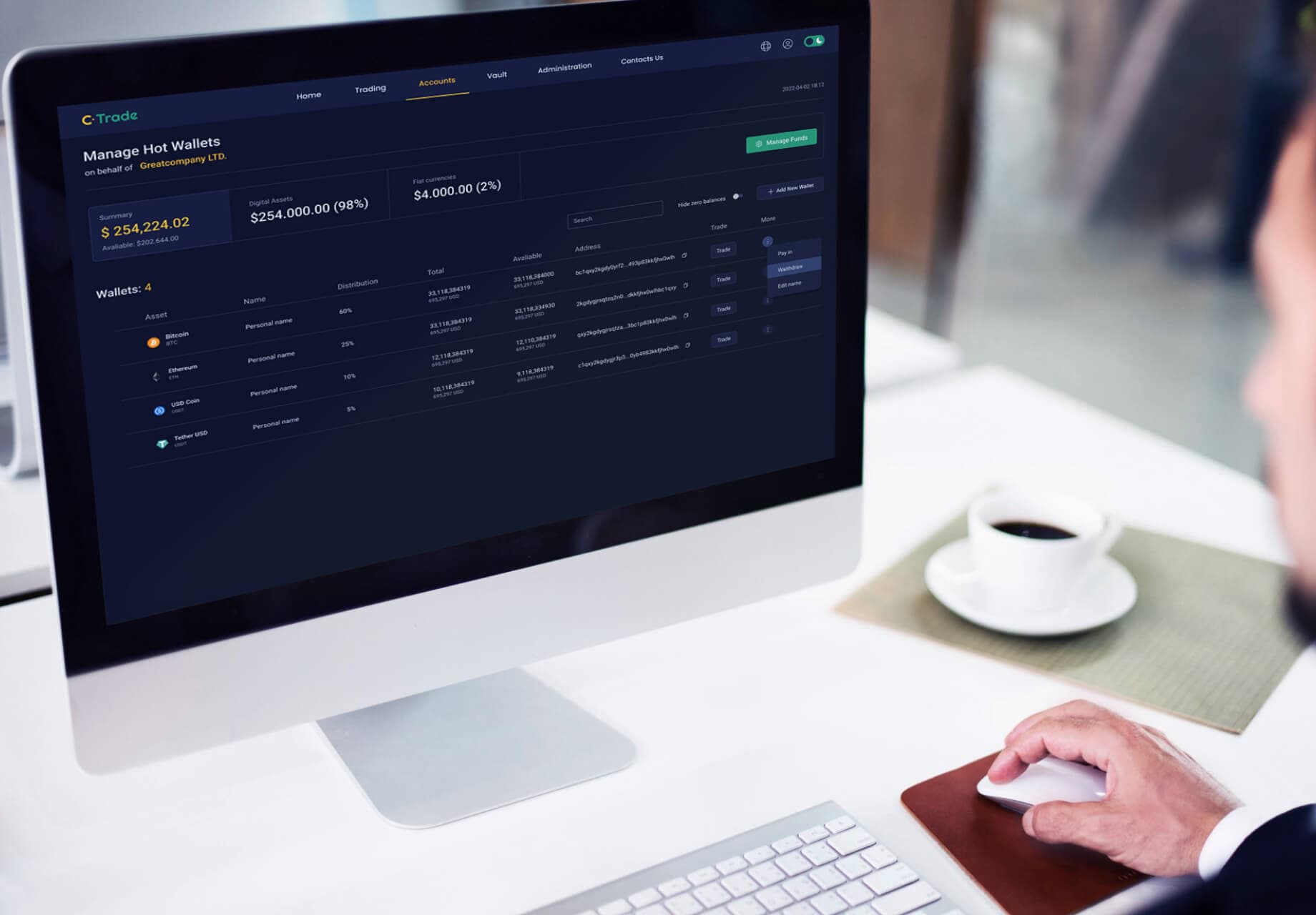

Digital Banking Solution

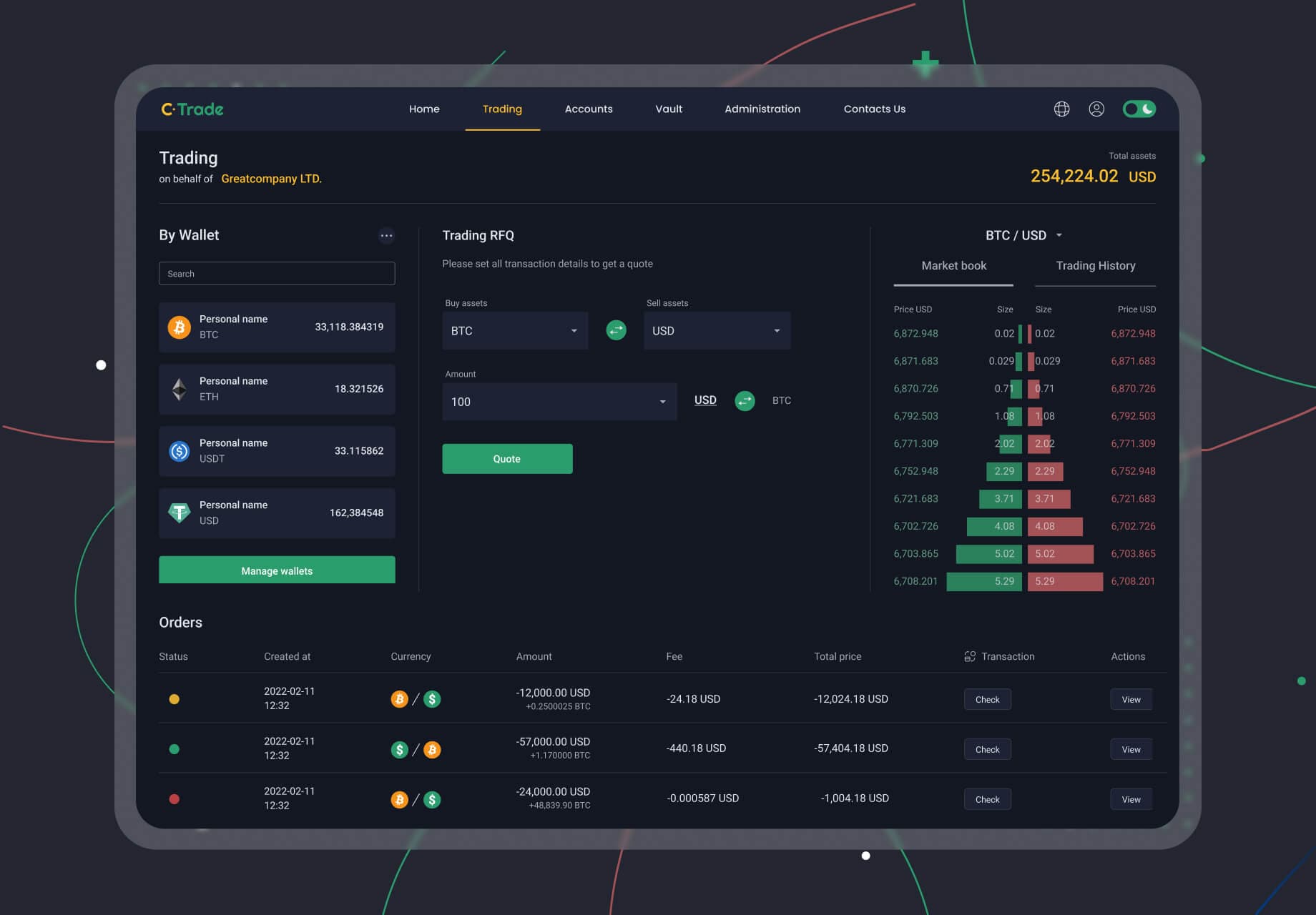

For a UK-based digital asset execution company, DeepInspire built a digital banking solution that enables other services to manage crypto & fiat wallets and trade within them.

Technologies:

.Net Core 5, MSSQL, AWS, Jenkins, Bitbucket, Nginx, Prometheus, Grafana

About the client

The client is a UK-based digital asset execution company providing OTC trade negotiation and execution service. The service allows institutional traders to execute large block cryptocurrency trades through a safe and secure platform with transparent prices.

The client offers various services, including:

- institutional grade KYC/KYB;

- direct access to unrivalled cryptocurrency market liquidity with complete privacy;

- API integrations that allow functionality to be integrated to counterpart platforms or institutional partners;

- token issuance and sale proceeds conversion.

Location:

United KingdomDomain:

Fintech, TradingContent

- 01Challenges

- 02Team composition

- 03What We Covered

- 04Value Delivered

Team composition:

In general, 7 specialists are involved in the project (the project is currently ongoing).- Solution Architect

- QA Automation Engineer

- DevOps Engineer

- .Net Developers

- Project Manager / Analyst

- Project Manager Assistant

What we covered

- 01Set up product infrastructure in AWS

- 02Design and development of product deployment

- 03Design and development of project development flow using BitBucket, Jira and Jenkins

- 04Requirements refinement

- 05Designing API specifications

- 06Back-end development in .Net Core

- 07Design and development of automated Quality Assurance using Postman

- 08Development of Product & Project Documentation incl. detailed user manuals

- 09Release management and support operations for production environment

Deliverables

We designed and developed a Digital Banking Solution with the full support of ledgers in fiat and crypto.

- The system provides the ability for API consumers to open and manage their ledger accounts both in crypto and fiat;

- The system provides the ability for end-users to trade crypto to fiat, and crypto to crypto, with getting price and information on resulting balances beforehand;

- The engine manages its own domain transactions;

- Introduced transactions compliance flow and automated compliance module to simplify manual workflows;

- Introduced notifications system to prevent any fail cases and ensure system stability;

- The system architecture makes it liquidity provider agnostic;

- The system fulfils the treasury function under the hood;

- Fees and brokerage fees;

We built a digital banking solution

with the full support of ledgers in

fiat and crypto.

Case

studiesView all