Some thirty years ago, dealers and brokers gathered on brick-and-mortar trading floors to trade bonds, commodities, currencies, stocks, and other assets. Moreover, in most exchanges, private traders and retail investors couldn’t take part in the trades. They had to place orders with banks or brokers to transfer these orders to brokers on the trading floors.

In the late 1990s, after the advent of the internet, this slow and costly process was replaced by online trading platforms, which have revolutionised the financial industry. Early platforms, like E-Trade and Ameritrade, emerged during this period, allowing users to execute trades electronically from their computers. The dot-com boom fueled the growth of online trading platforms as more people gained access to the internet and sought to invest in stocks. This period saw a surge in the number of online brokerage firms and trading platforms. But how does the situation stand today?

If you view building a trading platform as a business opportunity, stay on this page. Our guide contains everything you might want to know about trading platform development, from definition and monetisation strategies to the top trading platforms on the market and the development process.

What is a trading platform?

A trading platform, also called an electronic or online trading platform, is a software application engineered to enable the selling and buying of financial products, such as bonds, commodities, currencies, derivatives, stocks, and others. The assets can be traded directly between platform members or via an intermediary.

Among other features, trading apps usually give users access to analytical tools that provide insights into real-time market data, delivering a comprehensive market view and facilitating more informed trading decisions.

Types of trading platforms

Modern trading platforms fall into two major types: traditional and crypto trading platforms. Let’s take a closer look at each.

Traditional stock trading platforms

Traditional stock trading platforms enable investors to buy and sell stocks and other securities in traditional financial markets such as stock exchanges. These platforms provide access to a broad array of stocks listed on various exchanges, allowing investors to execute trades, monitor market activity, and manage their investment portfolios.

Cryptocurrency trading platforms

Cryptocurrency trading platforms operate similarly to traditional stock trading platforms. However, they are specifically designed for cryptocurrencies, which users can buy, sell, and exchange. These platforms allow for trading between different cryptocurrencies (crypto-to-crypto trading) as well as between cryptocurrencies and fiat currencies (crypto-to-fiat trading pairs).

Market overview

Trading platforms have seen a dramatic rise in popularity over the past few years, mainly because they have democratised access to financial markets, enabling individuals from all walks of life to engage in trading activities. The global online trading market, which constituted $10.21 billion in 2022, is projected to increase to an estimated $13.3 billion in 2026.

Online platforms enable users to execute trades globally, monitor market activity, and manage their investment portfolios 24/7. In addition, many trading platforms offer access to multiple asset classes, including commodities, currencies, derivatives, and cryptocurrencies. The variety of additional features provided by modern trading applications makes trading simple and convenient, constantly attracting more new users.

How can a trading platform make money for your business?

Given the impressive growth of trading systems, there’s little wonder that trading platform development is in high demand today. So why are businesses investing in trading software development? Well, there are several ways you can monetise a trading platform:

- Transaction fees. You can charge users a fee for each trade executed on the platform, either a flat fee per trade or a fixed percentage of the transaction value.

- Subscription fees. Many platforms offer users a subscription-based pricing model where they pay a monthly or annual fee to access premium features.

- In-app purchases. You can offer various add-ons to monetise your platform, such as premium market analytics reports, expert trading advice, or educational resources.

- Funds transfer fees. Trading platforms may charge fees for depositing and withdrawing funds. While some platforms charge fees for deposits and withdrawals, most collect fees only for withdrawals.

- In-app advertising. You can display targeted advertisements or sponsored content on the trading platform and earn revenue through advertising partnerships or affiliate programs.

- White-label solutions. As a trading platform developer, you can licence it to other businesses, allowing them to brand and customise the platform for their own use, charging licensing fees or royalties.

Trading platform features

If you’re considering trading platform development as a business opportunity, it’s essential to understand the key features that can make your solution stand out in the competitive market.

Must-have features

Here are the core features of a trading platform that help ensure compliance with legal requirements and user satisfaction.

User authentication

It’s essential to implement robust user authentication processes, including Know Your Customer (KYC) and Know Your Business (KYB) verification. This helps minimise the risk of fraudulent activities and ensure compliance with regulatory requirements.

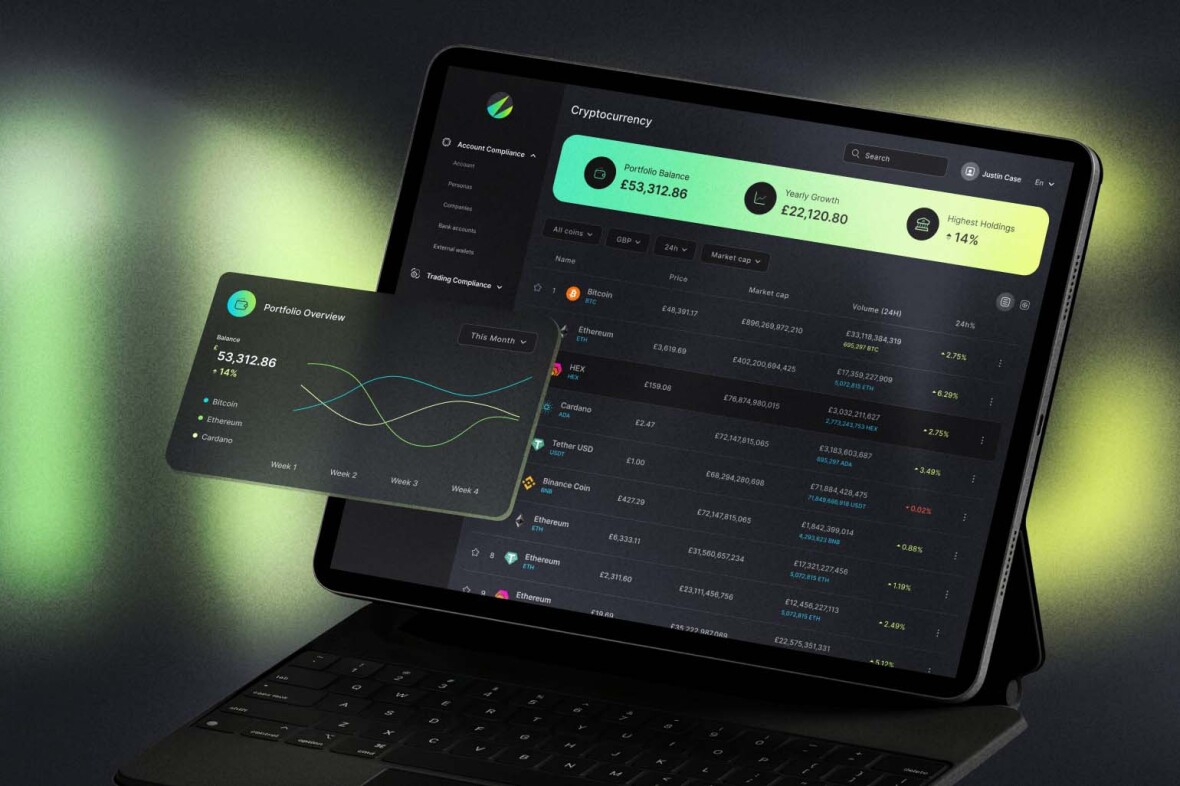

Profile dashboard

A personalised dashboard displays critical account information, such as portfolio value, holdings, recent transactions, and performance metrics. A user-friendly dashboard enhances transparency and lets users easily track their investment activities, boosting user loyalty and satisfaction.

Portfolio management

Portfolio management tools allow users to view, analyse, and efficiently manage their investment portfolios. By providing a comprehensive view of their portfolios, this feature facilitates effective risk management and optimised asset allocation.

Third-party integrations

Integrating your platform with external services, such as financial data providers, payment gateways, and trading APIs, can substantially enhance its functionality by giving users access to advanced features and services.

Order management

This feature allows users to seamlessly place, modify, and cancel orders for buying and selling assets. In addition to ensuring timely order execution, an intuitive order management tool can substantially enhance the overall trading experience.

Money deposit and withdrawal

When building an online trading platform, make sure it can let users deposit and withdraw funds from their accounts in a secure and convenient way. Create rewarding user experiences by offering multiple payment methods to accommodate various user needs and preferences.

Treasury management

The treasury management feature lets users oversee the inflow and outflow of funds, manage liquidity, and optimise cash flow within the trading platform. It helps maintain financial stability and mitigate risks associated with fund management.

Back-office automation

A lot is happening behind the scenes of a trading platform, so it’s essential to automate back-office operations such as account reconciliation, transaction processing, and regulatory reporting. Back-office automation improves operational efficiency, reduces manual errors, and streamlines administrative tasks, allowing the staff to focus on more strategic activities.

Real-time analytics and reporting

Real-time market data, analytics, and reporting tools allow platform members to monitor market trends, track portfolio performance, and gain insights into trading activities. This feature facilitates more informed decisions, ultimately leading to greater user satisfaction.

Customer support

You can offer users multiple channels, including live chat, email, and phone support, to assist them with account-related inquiries, technical issues, and trading queries. Prompt and effective customer support enhances user satisfaction and fosters trust and loyalty.

Nice-to-have features

In addition to the must-have feature list, you can offer your users advanced features that enhance functionality and a next-level trading experience.

AI-assisted trading

Artificial intelligence (AI) algorithms can offer users intelligent trading suggestions and personalised insights, thus helping them optimise their investment strategies, maximise returns, and navigate financial markets more effectively.

Automation of trading strategies

This feature enables platform users to automate their trading strategies through algorithmic trading tools. This results in greater flexibility, efficiency, and precision in executing trades while streamlining the trading process and minimising the need for manual intervention.

Social trading platform integration

Integrating social trading functionality allows users to connect with other traders, share insights, and replicate successful trading strategies, ultimately leading to more informed investment decisions.

Customisable alerts

You can allow users to set customisable alerts for price movements, new events, etc., helping them stay informed and promptly react to changing market conditions.

Educational resources

Offering users educational content within your platform, such as tutorials, webinars, and articles, can empower them with the knowledge and skills they need to succeed in the financial markets and provide you with an additional revenue stream.

Top trading platforms on the market

As mentioned, the online trading platform market has seen dramatic growth in the past couple of years. Today’s platforms are designed to make trading financial instruments more accessible and easier to a broader user base, attracting even those without experience in the trading industry. Let’s take a look at the most popular trading platforms.

Active Trader Pro by Fidelity

Active Trader Pro is a comprehensive desktop platform packed with useful tools for data-driven trading. The platform offers 45+ market filters, including technical, social sentiment, and custom options filters, and enables users to trade ETFs and equities with extended hours and directed trading capabilities. Active Trader Pro allows you to create and save up to 50 orders to place them at the right time, manage risk and profit potential with conditional orders, monitor your portfolio with streaming quotes, streaming balances, real-time gain and loss, and streaming order status updates.

Coinbase

One of the largest cryptocurrency exchanges, Coinbase, enables individual traders and businesses to buy, sell, and manage crypto simply and securely. In addition, the platform offers the best-in-class cold storage to protect your assets. Beyond the core functionality, Coinbase provides powerful analytical tools that help the company deliver the ultimate trading experiences to its users, allowing them to tap into real-time order books, sophisticated charting capabilities, and deep liquidity across hundreds of markets.

E*TRADE

E*TRADE offers two easy-to-use tools — Power E*TRADE web and Power E*TRADE app — to help seasoned traders spot trends and leverage potential opportunities. According to E*TRADE, their web platform is an original and the best place to invest online. It enables trading bonds, ETFs, mutual funds, options, and stocks with a user-friendly order ticket. The platform provides quick access to cash with free check writing, ATM/debit cards, Bill Pay, and unlimited money transfers. The award-winning E*TRADE mobile app is perfect for trading, investing, tracking the markets, and managing accounts on the go. It can be used with Android and Apple devices, including Apple Watch.

Firstrade

Firstrade is an online trading platform that allows users to trade a broad range of investment products, including bonds, exchange-traded funds (ETF), mutual funds, options, and stocks. The platform offers two types of accounts: a brokerage account and a retirement account. Firstrade positions itself as a platform with straightforward pricing, removing commission trades, options contract fees, minimums, inactivity fees, and other standard charges. Firstrade lets you manage your account and trade assets from your desktop, iPad, or mobile phone. High-quality educational resources, two-factor authentication, and insurance for up to $500,000 are among Firstrade’s outstanding features.

Gemini

Gemini is a robust crypto exchange complemented with a high-performing mobile app. The platform provides a straightforward, user-friendly interface that offers an extensive suite of tools to help you get an idea of the crypto market and start investing. Depending on their location, Gemini users can view trading options on over 300 trading pairs. Gemini allows you to set recurring buys and dynamic price alerts and enable crypto withdrawals to go only to approved addresses. The mobile application provides the same functionality, delivering a sophisticated trading experience for mobile users.

IBKR Trader Workstation (TWS)

IBKR Trader Workstation stands out among a comprehensive range of trading tools by Interactive Brokers. The desktop IBKR Trader Workstation is the company’s flagship product designed for experienced, active traders who trade multiple assets and require power and flexibility. IBKR Trader Workstation allows users to trade bonds, currencies, funds, futures, options, and stocks on over 150 markets globally from a single platform. Besides quick and easy access to comprehensive trading, order management, charts, watchlists, and portfolio tools, the platform offers real-time access to news, research, and market data.

Lightspeed Trader

Lightspeed Trader is Lightspeed’s flagship trading platform, perfect for active and professional traders seeking reliability, performance, and speed. It’s a robust multi-asset platform that utilises the latest trading technologies to let users efficiently trade stocks and options. No matter their experience levels, traders can easily set up and view option risk graphs and option watchlists, while the options scanner lets them view the most active options, options with unusual volume, or underliers in real time. Lightspeed Trader is renowned for its advanced customisation options that allow you to personalise almost every aspect of the trading platform, from customising screens to creating custom orders.

Robinhood

One of the top crypto exchanges in the world, Robinhood positions itself as a platform that offers the lowest cost of crypto trading. Robinhood provides advanced trading tools such as custom price alerts, advanced charts, and more to let users effectively build trading strategies and manage crypto assets. With Robinhood, you can easily and securely transfer crypto between your Robinhood account and other crypto wallets without being charged deposit or withdrawal fees. The platform offers cold storage for most coins and insurance against theft and cybersecurity breaches.

Schwab

The Schwab.com web platform and Schwab mobile app help users research, execute, and manage trades quickly and easily. They enable viewing and managing current trade positions, opening orders for multiple accounts, filtering and identifying trading candidates that meet your custom criteria, and comparing up to five products simultaneously against fundamentals, to name a few core features. In addition, these products allow you to explore real-time market data and market news and get the latest market commentary from the Charles Schwab and third-party experts.

tastytrade

Besides high-performing stock trading software for desktops, tastytrade offers a web platform and a mobile solution for trading products such as stocks, futures, and cryptocurrency. The desktop application is the most feature-rich trading platform, offering an intuitive click-and-drag user interface to make navigating stock markets quick and easy. It allows you to visualise price action with the advanced charting features, simultaneously view multiple stocks and futures charts, access hundreds of chart indicators and studies, view historical options data, follow curated watchlists or create your own, stay up-to-date with live trade news feeds, and set alerts when products reach specific prices, to name a few.

Our trading platform software development process

The team at DeepInspire has decades of experience developing financial software, including trading solutions. Extensive experience in financial technology allowed us to create a tried-and-true approach to trading platform development.

1. Discovery phase

First, we conduct a discovery phase to establish a solid base for your online trading platform project. This usually involves:

- Defining project goals

- Determining your target users and their pain points

- Researching your major competitors, identifying their strengths and weaknesses, and working out how you may profit from their shortcomings

- Devising your value proposition

- Outlining the key features of your solution

- Gathering project requirements

- Defining the project scope

2. Selecting the technology stack

Next, we decide on the best technology stack for developing your software product. This includes programming languages, tools, frameworks, libraries, and software components we’ll need to develop, deploy, and maintain the solution. The choice of tech stack primarily depends on your business goals and project requirements. The tech stack determines the level of your app’s or platform’s scalability, performance, security, and flexibility. Moreover, the choice of technology stack is crucial if you plan to integrate third-party APIs.

3. Design phase

UI/UX design plays a starring role in your application’s success with users, directly affecting the ROI you’ll get. During the design phase, we make sure your application is easy to navigate. We focus on simplifying complex workflows and processes, enabling users to fulfil tasks with minimal effort. Our team designs visual elements, including colour schemes, typography, and branding, and creates wireframes and prototypes to visualise the trading platform or app’s layout, navigation, and user flow.

4. Building an MVP

Given the keen competition in the online trading platform market, building an MVP is a reasonable choice. It helps you validate the concept, test assumptions, and learn from user interactions with minimal time and resources. By developing an MVP before you build trading software with the full suite of features, you minimise risk and ensure that your solution meets user needs.

5. Testing and deployment

Our testing experts utilise a tried-and-true combination of automated tools and manual methods to spot and resolve issues, validating your solution’s functionality, performance, and security. Once the testing phase is complete and the application is ready for release, we deploy it to production servers or cloud platforms.

6. Full-scale product development

In the competitive realm of online trading platforms, moving from MVP to full-scale development is a crucial step towards realising your vision. This phase shifts focus from validation to comprehensive implementation, refining user experience and expanding feature sets. Full-scale development ensures your platform remains competitive, scalable, and compliant. While challenging, the transition to full-scale development demonstrates your commitment to excellence and prepares you for long-term success in a changing market.

7. Maintenance and support

Our stock and cryptocurrency trading platform development services include continuous maintenance and support to ensure your solution runs seamlessly. We continuously monitor the trading platform’s performance, security, and stability and release updates and patches to add new features, improve existing functionality, and address security vulnerabilities.

We want to emphasise that the process we described is very approximate and simplified. In practice, the development phase usually consists of many iterations (develop – test – deploy – gather feedback), ensuring maximum alignment with business goals and user expectations.

Final thoughts

With the increasing popularity of stock and cryptocurrency trading, there’s a growing demand for trading platforms. Trading platforms are a lucrative business option since they offer multiple revenue channels, including trading fees, premium features, advertising, and educational resources, among others.

The team at DeepInspire has relevant expertise and decades of experience in fintech. We can help you build a high-performing custom trading platform according to your unique business needs and requirements. Contact us to discuss how we can help.