Among other disruptive technologies, blockchain is revolutionising traditional banking systems. Blockchain’s decentralised and immutable ledger provides enhanced security and transparency, mitigating fraud, reducing errors, and fostering trust among stakeholders, to name a few key benefits.

If you’re a bank or financial services company considering implementing blockchain as part of your digital transformation strategy, stay on this page. In this article, we’re taking a closer look at blockchain technology, explaining its role in banking and providing some real-life examples of industry leaders leveraging this technology.

What are blockchains, and how do they work?

Blockchain technology is a state-of-the-art database mechanism that enables a transparent process of recording transactions and tracking assets within a business network. A blockchain database stores data in multiple blocks linked in a chain.

Blockchain is based on distributed ledger technology, with each network participant having access to the ledger and its immutable record of transactions. The shared digital ledger ensures that every transaction is recorded only once, removing duplication.

Due to blockchain’s immutable nature, it’s impossible to change or tamper with a transaction recorded to the distributed ledger. If a record has an error, a new transaction is added, and both transactions — the erroneous and the new one — are visible.

Smart contracts are essential elements of blockchain technology. They are stored on a blockchain and are automatically executed once predefined terms and conditions are met. This way, smart contracts help automate the execution of agreements so that all participants are instantly informed about the outcome, eliminating the need for intermediaries and saving time. Likewise, they can be used to automate workflows, triggering the actions when predefined conditions are fulfilled.

What are the advantages of blockchain in banking and finance?

Transparency, immutability, decentralisation, and security provided by blockchain technology help ensure more secure transactions, making it especially valuable for the financial services and banking industry.

Here’s an overview of the top benefits of blockchain technology for these sectors.

Reduced costs

Blockchain solutions allow banks and financial institutions to eliminate intermediaries and streamline processes, which can substantially reduce transaction costs.

Strong security

Immutability and decentralisation make blockchain highly secure against fraud and unauthorised tampering. In the context of financial transactions, this helps minimise risks associated with cyber attacks and data breaches.

Instant settlement

Blockchain technology allows banks and other financial institutions to operate without intermediaries, resulting in near real-time settlement, which also applies to cross-border payments.

Digital currencies

With blockchain, banks can accept and process digital currency payments, which allows them to cater to a diverse use base.

Minimised error

Transactions recorded on blockchain cannot be altered or deleted, reducing the risk of human error. In addition, smart contracts automate contract execution, further minimising the potential for errors.

Applications of blockchain in banking and finance

P2P lending and borrowing

Blockchain applications let individuals and businesses directly connect and transact without the need for intermediaries like traditional banks or lending institutions.

The immutable nature of blockchain facilitates trust and transparency in lending transactions. Each lending activity is recorded on the blockchain network, creating an auditable and transparent history accessible to the participants of the lending process.

By providing individuals and entities having limited credit histories with access to lending services, blockchain-based platforms also promote financial inclusion, catering to the needs of people and businesses underserved by traditional financial institutions.

Accounting

Blockchain provides a transparent and secure ecosystem for storing records. Accounting data added to the blockchain can’t be modified or deleted; moreover, it’s available in real time to all relevant stakeholders, removing the need to reconcile various versions of records.

Accounting data stored on the blockchain can serve as a single source of truth, leading to more efficient and accurate financial reporting and a streamlined auditing process.

Trading

Banks and financial service providers can build trading platforms on a blockchain protocol. Such a platform allows users to exchange financial assets without intermediaries, resulting in substantial cost savings.

As mentioned, blockchain can minimise the risk of fraud, which also applies to trading platforms. In addition, the ultimate traceability of historical records can back up the authenticity of every asset. So how does it work?

When a high-value item is produced, a central authority issues a digital token to authenticate its point of origin. Every instance of selling and buying this item is recorded on the blockchain through the digital token, which serves as a virtual certificate of authenticity.

Fundraising

Blockchain enables decentralised crowdfunding platforms, removing geographical barriers and accessing a global pool of investors without relying on traditional financial systems. Blockchain-powered trading platforms use smart contracts to automate the fundraising process, ensuring transparency and accountability.

For example, an Initial Coin Offering (ICO) is a renowned method blockchain projects use to raise funds by issuing and selling their own crypto assets. A decentralised and borderless crowdfunding method, an ICO allows startups to reach a global pool of investors and benefit from a streamlined fundraising process.

Personal finance

Blockchain technology provides decentralisation, immutability, and security, revolutionising the way people manage their personal finances. As highlighted earlier, blockchain makes financial services more accessible to the unbanked and underbanked population, fostering financial inclusion on a global scale.

Moreover, by removing intermediaries, blockchain enables direct transactions between individuals, enabling faster settlement and reducing fees.

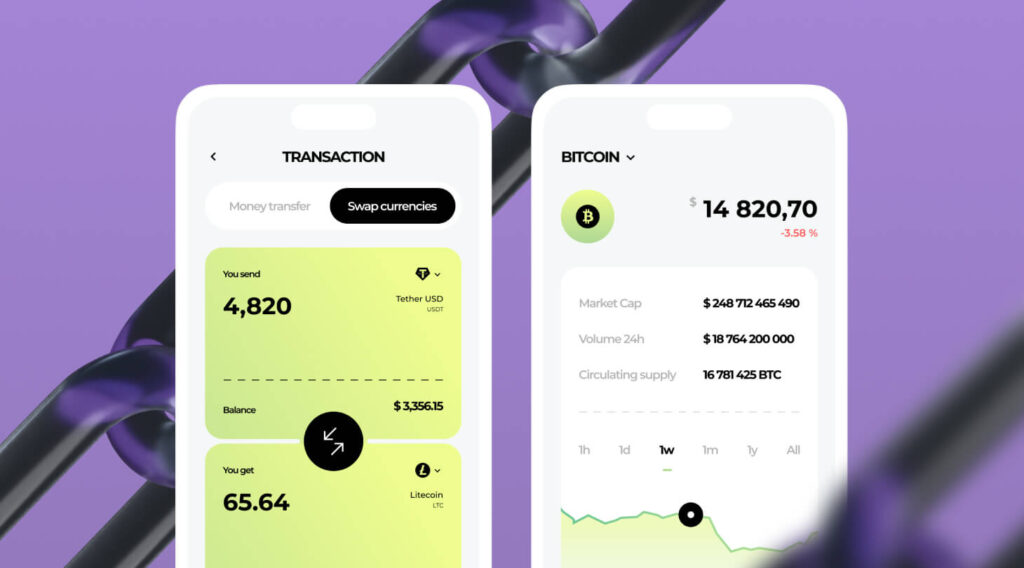

Crypto banking

Blockchain is key in crypto banking. It provides a secure and immutable ledger for crypto transactions, making them transparent and tamper-proof.

Crypto banking allows customers to transfer digital assets peer-to-peer within the blockchain network and enables them to make cross-border transactions and remittances in crypto.

This way, blockchain empowers banks to deliver innovative banking services, catering to diverse customers needs, offering unprecedented transaction speed, lower fees, and greater financial autonomy.

KYC (Know Your Customer)

Blockchain can significantly streamline KYC, a regulatory process within the financial services sector that requires institutions to verify their clients’ identities and the potential risks associated with them.

While this process can be rather time-consuming in the traditional context, blockchain-based identity verification solutions offer a more efficient alternative. Thanks to blockchain’s immutability, identity information recorded on it can’t be modified or tampered with, making it impossible for bad actors to manipulate it. This introduces the element of trust needed to verify identity more efficiently.

As a result, an individual can undergo the verification procedure once, and the validated identity data can be securely shared with finance services providers without the need for repetitive document submission.

Blockchain in banking and finance: real-life examples

With the multiple benefits of blockchain, its potential to revolutionise traditional finance services is hard to underestimate. Many finance and banking sector leaders have already implemented blockchain-based systems. Let’s explore some prominent examples of blockchain disrupting financial operations.

HSBC

HSBC, a British universal bank and financial services group, employs blockchain to power its Digital Vault, a custody blockchain platform launched in 2019. HSBC primarily views blockchain technology as an opportunity to provide safe and secure storage for digital assets. Moreover, moving their custodian service to blockchain enabled HSBC to reduce its fees.

Digital Vault digitises the transaction records of debt, equity, and real estate assets. This provides the bank’s custody clients with direct access to the details of their assets in real time and from anywhere, removing the need to request a search of paper-based documents.

HSBC employs the Corda blockchain technology, which will allow it to extend its blockchain initiatives in the future, for example, by offering digital tokens instead of paper certificates and enabling business customers to transact directly via smart contracts.

J.P. Morgan

J.P. Morgan, one of the U.S. banking giants, launched Onyx, a blockchain-based platform, in 2020. The platform’s primary goal is to automate payment and settlement processes. It comprises four services: Liink, Coin Systems, Digital Assets, and Blockchain Launch.

- Liink is a P2P network for secure data exchange, which allows participants to build applications running on shared information. Network participants can exchange data privately while controlling how it is shared and who can use it.

- Coin Systems is a digital solution that enables real-time transfer and clearing of multi-bank, multi-currency assets on a distributed ledger.

- Digital Assets is an asset tokenization platform that allows financial institutions and fintech companies to increase asset utilisation and mobility. By recording and representing assets as programmable tokens, Onyx enables real-time settlements.

- Blockchain Launch is a blockchain team Onyx offers to its clients to help them build blockchain-based products.

Swedish Central Bank

Since 2017, the Swedish Central Bank has been exploring ways to introduce e-krona, a currency that would serve as a digital complement to fiat money. For this, the bank uses a Corda distributed ledger.

The project started with an analysis of the market and regulatory landscape. In 2020, a tech solution for e-krona was launched, marking the pilot phase of the project.

The Swedish Central Bank chose to go the MVP route to validate the concept and learn more about its capabilities. Currently, the bank is developing technology solutions for the e-krona and researching its potential effect on the country’s economy.

Unlock the potential of blockchain with DeepInspire

Blockchain opens up numerous opportunities for banks and other financial institutions to streamline their operations and deliver seamless customer experiences.

If you’re looking to build a blockchain banking solution, DeepInspire has you covered. Our team has unrivalled experience in blockchain, banking software development, and open banking integrations and can help you build a robust blockchain-powered application.

FAQ

How is blockchain used in money transfers?

Blockchain enables peer-to-peer transfers without the need for intermediaries like banks. By recording transactions on a decentralised ledger, blockchain ensures immutability and reduces the risk of fraud or error. This ultimately leads to more secure, transparent, and efficient transactions.

Will blockchain revolutionise banking?

Yes, and it has already started to. Blockchain technology has an enormous potential to streamline many processes, reduce costs, and strengthen security. It enables faster and cheaper cross-border payments, facilitates transaction transparency, and simplifies complex financial operations.

How many banks have a blockchain?

It’s hard to estimate the accurate number of banks using blockchain since while some are piloting projects, others, such as Goldman Sachs, J. P. Morgan, Swedish Central Bank, HSBC, and others, have already fully integrated blockchain into their operations.

Are UK banks blocking cryptocurrency?

In autumn 2023, some UK banks, including Santander, NatWest, and Chase UK, suspended cryptocurrency transactions due to the growing number of cryptocurrency-related crimes.